I had the same issue. After 4 phone calls, I finally got some good help from someone.Holy frack, just got off phone with FCA incentives like banging my head at a brick wall with broken glass embedded in it.

Hi can you give me what incentives I qualify for....

Well let's see you qualify for this one here oh I see you qualify for that one.... Hmm and maybe....

Can you tell me what they are I can't see your screen...

Can you tell me the pricing and the code I can't see your screen.

Can you just do your job!

I got nothing out of it other than there is something called bonus bucks for $250 which may or may not be the code 44cmk1

5thGenRams Forums

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Price negotiated from MSRP

- Thread starter Jared B

- Start date

scottmoyer

Ram Guru

- Joined

- Nov 13, 2020

- Messages

- 1,260

- Reaction score

- 1,233

- Points

- 113

Having an 850 credit score, the best I could get from Chrysler was 4.38%. I am refinancing with Navy Federal at 2.19% and applying a down payment when I do. The 1 month of interest at the full purchase price does deflate the $500 rebate for financing with Chrysler, but it was simpler to do it this way since I was not actually onsite with the dealer.Scott,

Are you willing to disclose the finance rate you got from Chrysler Capital?

Regarding the Tread Lightly discount, I never asked because I don't have it and wouldn't qualify. I asked Lakeland about it when I was price checking because I was told that I would get the best price using it at their dealership. When I was contacted by Mark Dodge, the price they provided was better than what Lakeland offered with that discount so I never tried stacking additional. I was happy with my deal.

WReckeR

Well-Known Member

Thanks Scott,Having an 850 credit score, the best I could get from Chrysler was 4.38%. I am refinancing with Navy Federal at 2.19% and applying a down payment when I do. The 1 month of interest at the full purchase price does deflate the $500 rebate for financing with Chrysler, but it was simpler to do it this way since I was not actually onsite with the dealer.

Regarding the Tread Lightly discount, I never asked because I don't have it and wouldn't qualify. I asked Lakeland about it when I was price checking because I was told that I would get the best price using it at their dealership. When I was contacted by Mark Dodge, the price they provided was better than what Lakeland offered with that discount so I never tried stacking additional. I was happy with my deal.

4.38% is a little higher than I expected. That tells me that's where they make up the difference. Were you already a member at Navy Federal, or did you join solely to get their rate? They've advertised on Facebook, but I'm not currently a member.

Ram1500OwnerMaybe

Well-Known Member

... when did dealers start adding "dealer add-ons"? I have bought 4 vehicles in 2 years, and this did not come about until looking for a Ram 1500. Did this start becoming more obvious with COVID? I know why they are doing it, they show a "lower" sales price of truck on the web, then you go into the dealer and then the include the dealer add-ons, and you are basically at the same spot as other dealerships who DO NOT charge for add-ons.

Dealer add-ons have been a thing for a while.

Car/Truck sales is an ever evolving process. As the consumers become more educated, the dealers have to become more creative in ways to squeeze out money.

Remember what cash was king and that was the way to get a better deal? Now, financing a vehicle is the way to go.

Now, they charge for nitro in the tires and stuff.

In a few years it will have evolved again. Oh you want your vehicle painted.....thats a dealer add on fee.

Sorry to jump in a little late here. I had a 5.5% from FCA. Credit score 810. I refinanced almost immediately. Scott was right that it did eat up a little of the $500 rebate, but I felt that the dealer came down more on the price because I said I'd finance w/ FCA. In Florida, there's a few other often forgotten fees from the state when you finance and refinance ("stamp tax") that's $.35 per 100 recorded. If your state has one of these, you'll end up paying this twice: once on the first loan, again on the refinance.Thanks Scott,

4.38% is a little higher than I expected. That tells me that's where they make up the difference. Were you already a member at Navy Federal, or did you join solely to get their rate? They've advertised on Facebook, but I'm not currently a member.

In hindsight, going with FCA was probably not worth the pain to save ~$50-100; but I'm not sure how much I really "saved" with the dealer coming down in price because I was going with FCA, either.

Navy Federal is currently running a $200 deal to start a new account / refinance with them (see below). So it may be worth it. I was quoted 2.29% (72 mo) from them. But ended up staying with my bank, USAA. But my understanding is that you can open an account with them for the sole purpose of refinancing.

"Existing Navy Federal loans are not eligible for this offer. Refinanced loan must be at least $5,000 to be eligible for the $200. You must make your first scheduled payment in order to receive this offer. $200 will be credited to the primary applicant’s savings account between 61 and 65 days of the loan origination date. If the auto refinance loan is canceled or paid off in the first 60 days, the $200 offer will become invalid. Offer may end at any time. Recipient is solely responsible for any personal tax liability arising out of this incentive."

Last edited:

Dodgeramfan

Active Member

- Joined

- Nov 20, 2020

- Messages

- 35

- Reaction score

- 30

- Points

- 18

I have a credit score just over 800. My FCA rate was 3.47% (5 years). While an ok rate, I still refinanced with PenFed at 2.14% (2 years).

Shockingram

Member

- Joined

- Sep 11, 2020

- Messages

- 19

- Reaction score

- 17

- Points

- 3

- Age

- 52

Terrible.

I paid less OTD (taxes tags the whole shavang) with 0% for 60 months on a 72k msrp limited than option 1 for you.

From my understanding you get the $500 rebate and nothing else. I called FCA incentives on this exact question and a dealer.I’m seeing a 0% financing offer on the RAM website for Limited and Longhorns but I’m guessing that option wouldn’t tie in with the $2000 cash incentive. It’s probably one or the other unfortunately.

Shockingram

Member

- Joined

- Sep 11, 2020

- Messages

- 19

- Reaction score

- 17

- Points

- 3

- Age

- 52

I thought I had a very reasonable deal on an ordered Ram and it comes in and now they are hesitating and adjusting. $74,245 MSRP sales price $64,897 was what they agreed to but now that it comes they say they were giving me employee pricing and it doesn’t work with my bonus cash so I am not happy right now and my truck is at the dealer. They said they can do $1500 rebate or the $500 and 0%.

Eldodroptop

Active Member

- Joined

- Dec 19, 2020

- Messages

- 149

- Reaction score

- 247

- Points

- 43

- Age

- 55

You can get your invoice price online. On this link, just select your trim level and options. It will give you the correct MSRP and invoice price.So on my build order, is there invoice price listed? Also is FFP below invoice?

Ram Truck Ratings, Pricing, Reviews and Awards | J.D. Power

Research Ram Truck new and used prices, compare specs, and read consumer and expert reviews of the car you want.

Thats dumb they should have given you a heads up about that.I thought I had a very reasonable deal on an ordered Ram and it comes in and now they are hesitating and adjusting. $74,245 MSRP sales price $64,897 was what they agreed to but now that it comes they say they were giving me employee pricing and it doesn’t work with my bonus cash so I am not happy right now and my truck is at the dealer. They said they can do $1500 rebate or the $500 and 0%.

scottmoyer

Ram Guru

- Joined

- Nov 13, 2020

- Messages

- 1,260

- Reaction score

- 1,233

- Points

- 113

I am already a USAA and a Navy Federal member. The thing that works good with Navy Federal is that they acknowledge a refinance of a new vehicle as a new car loan if vehicle has less than 7500 miles. I have 1100 as of today, so I still qualify for a refi under new car qualifications. The 2.19% is for a 5 year loan, and that was the rate 2 weeks ago when I checked. It might be higher or lower when I actually complete the refi. Like I mentioned, I also have money down from the BMW I sold, so that will reduce the payment even more.

Call the FCA Incentives hotline. They can walk you through all of this. They can also tell you what rebates can be combined and what cannot. Honestly, the dealer I went to made it seem like applying rebates was a giant hassle. Thank goodness I called in advance and knew they were full of it. I offered to call the hotline for them at the dealership. Hotline number 1-800-227-0757I thought I had a very reasonable deal on an ordered Ram and it comes in and now they are hesitating and adjusting. $74,245 MSRP sales price $64,897 was what they agreed to but now that it comes they say they were giving me employee pricing and it doesn’t work with my bonus cash so I am not happy right now and my truck is at the dealer. They said they can do $1500 rebate or the $500 and 0%.

The hotline was also helpful when I got a $1500 direct offer rebate after I purchased (THANK YOU SECURITY GUY). The hotline told me it was no problem for them (the dealer) to adjust the rebate amount.

I was able to get $1500 cash on the Limited, $500 for financing with FCA, $1500 targeted offer (which replaced the $1000 truck conquest), and $500 military.

WReckeR

Well-Known Member

Can you share a link? I see 0% on Big Horns, but not on Limiteds. I would prefer 0% on a Laramie, because at the moment there is no Limited on any lot that I want. It sucks as a buyer when your preference is a 6'4" bed.I’m seeing a 0% financing offer on the RAM website for Limited and Longhorns but I’m guessing that option wouldn’t tie in with the $2000 cash incentive. It’s probably one or the other unfortunately.

Try this link and click the drop down and select Limited or whatever trim you want.Can you share a link? I see 0% on Big Horns, but not on Limiteds. I would prefer 0% on a Laramie, because at the moment there is no Limited on any lot that I want. It sucks as a buyer when your preference is a 6'4" bed.

vehicle-selector

See current deals, incentives, lease deals and other available offers on new Ram trucks in your area.

www.ramtrucks.com

Iceman6960

Member

- Joined

- Sep 10, 2020

- Messages

- 11

- Reaction score

- 29

- Points

- 13

- Age

- 58

Fairly new to the site, love all the valuable info! I have a question regarding the Chry Cap financing rebate. I had a deal put together for a 2021 Built to Serve that included the $500 Chry Cap rebate (plus some other additional $1,000 dealer based incentive for financing?). After getting the deal written up, dealer called me the next morning (prior to pick up) to tell me they couldn’t give me the $1,500 as I wouldn’t be financing enough. Only a $3k difference between my trade-in and the new truck. My trade is paid off and they incorrectly assumed I would be financing a large amount. As the last minute $1,500 increase in price just did not sit right, I walked on the deal.

My question; does anyone know if it’s possible to get a loan on a trade-in (Pen-fed, etc.) and then re-finance that loan with Chry Cap at time of purchase to get the additional $500 rebate? I’ll be checking with dealer on the additional $1,000 bonus cash but wanted to get some independent opinion on the $500 Chry Cap piece. May sound like a lot of trouble but I’m willing to sign a few loan papers if it means I can save $1,500.

My question; does anyone know if it’s possible to get a loan on a trade-in (Pen-fed, etc.) and then re-finance that loan with Chry Cap at time of purchase to get the additional $500 rebate? I’ll be checking with dealer on the additional $1,000 bonus cash but wanted to get some independent opinion on the $500 Chry Cap piece. May sound like a lot of trouble but I’m willing to sign a few loan papers if it means I can save $1,500.

ny2az

Well-Known Member

Here in Az,... even if your trade is paid in full... they can still finance pretty much any amount and cut you a check back ... ...Fairly new to the site, love all the valuable info! I have a question regarding the Chry Cap financing rebate. I had a deal put together for a 2021 Built to Serve that included the $500 Chry Cap rebate (plus some other additional $1,000 dealer based incentive for financing?). After getting the deal written up, dealer called me the next morning (prior to pick up) to tell me they couldn’t give me the $1,500 as I wouldn’t be financing enough. Only a $3k difference between my trade-in and the new truck. My trade is paid off and they incorrectly assumed I would be financing a large amount. As the last minute $1,500 increase in price just did not sit right, I walked on the deal.

My question; does anyone know if it’s possible to get a loan on a trade-in (Pen-fed, etc.) and then re-finance that loan with Chry Cap at time of purchase to get the additional $500 rebate? I’ll be checking with dealer on the additional $1,000 bonus cash but wanted to get some independent opinion on the $500 Chry Cap piece. May sound like a lot of trouble but I’m willing to sign a few loan papers if it means I can save $1,500.

Iceman6960

Member

- Joined

- Sep 10, 2020

- Messages

- 11

- Reaction score

- 29

- Points

- 13

- Age

- 58

Thanks for the info ny2az!Here in Az,... even if your trade is paid in full... they can still finance pretty much any amount and cut you a check back ... ...

On a related note, I wanted to confirm that Penfed $1,000 bonus cash is alive and well (got my code last night that’s valid thru 3/15). Apologies in advance if that isn’t news to anyone but I had been trying to get a code for the past couple weeks without any luck (maybe user error?).

Last edited:

securityguy

Legendary member

I believe that is the same in most states.Here in Az,... even if your trade is paid in full... they can still finance pretty much any amount and cut you a check back ... ...

kwbuxton

New Member

- Joined

- Jan 18, 2021

- Messages

- 2

- Reaction score

- 6

- Points

- 3

- Age

- 60

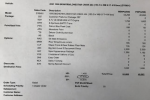

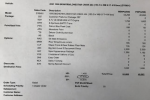

Always ask for the Priced Order Confirmation early in the process. If the sales person will not provide it, move on to another dealer.

The invoice on this POC is $48,082. The "HB" stands for Hold Back. That is what the dealer gets back from the manufacturer when they sell the vehicle. So... if you buy below invoice, they are NOT losing money. I would always start negotiation at the FFP (Friends and Family Price). Which is about 1.5% below invoice. You start there and THEN you get the rebates that may be available at that time. In this case, I started $47,676, got $4,000 in rebates, which took it down to $43,082, then the trade, and financed at 0% for 60 months. The MSRP of $51,005 was mentioned maybe once throughout the entire process. My dealer here in Wisconsin laid this all out for me without any pushback. I would highly recommend this dealership and salesperson to anyone looking for a Dodge, Ram, or Jeep. This is the second vehicle I have purchased from them. It is worth the drive to their dealership. If you ask for the POC, you will get it right away.

The invoice on this POC is $48,082. The "HB" stands for Hold Back. That is what the dealer gets back from the manufacturer when they sell the vehicle. So... if you buy below invoice, they are NOT losing money. I would always start negotiation at the FFP (Friends and Family Price). Which is about 1.5% below invoice. You start there and THEN you get the rebates that may be available at that time. In this case, I started $47,676, got $4,000 in rebates, which took it down to $43,082, then the trade, and financed at 0% for 60 months. The MSRP of $51,005 was mentioned maybe once throughout the entire process. My dealer here in Wisconsin laid this all out for me without any pushback. I would highly recommend this dealership and salesperson to anyone looking for a Dodge, Ram, or Jeep. This is the second vehicle I have purchased from them. It is worth the drive to their dealership. If you ask for the POC, you will get it right away.

Staff online

-

EightyModerator / Dream Killer