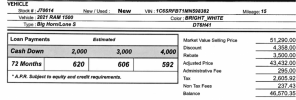

So these numbers aren't EXACT, but based on my memory from our phone conversations. I was going to ask for a itemized sheet before I did anything Monday, and it was spur of the moment stopping in with my friend after I just sold my other car, but wanted to see the truck because it's been a very difficult task finding a quad cab with premium lighting and a sunroof. But here it goes, and like I said, not EXACT:

50,990 MSRP x 13.5(ish)% percent off (this is with 0% financing, so discounts are not as much). Say $6,883 off=

$43,850 adjusted price

+$2,646 tax

+$500(ish) admin and non tax fees

--------------------------------

=$47,252

-$5,000 down

--------------------------------

=$42,252 / 72 months = $587/mo