kwbuxton

New Member

- Joined

- Jan 18, 2021

- Messages

- 2

- Reaction score

- 6

- Points

- 3

- Age

- 60

By-the-way, the car dealer is: https://www.reedchrysler.com/Always ask for the Priced Order Confirmation early in the process. If the sales person will not provide it, move on to another dealer. View attachment 79944

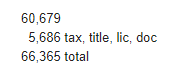

The invoice on this POC is $48,082. The "HB" stands for Hold Back. That is what the dealer gets back from the manufacturer when they sell the vehicle. So... if you buy below invoice, they are NOT losing money. I would always start negotiation at the FFP (Friends and Family Price). Which is about 1.5% below invoice. You start there and THEN you get the rebates that may be available at that time. In this case, I started $47,676, got $4,000 in rebates, which took it down to $43,082, then the trade, and financed at 0% for 60 months. The MSRP of $51,005 was mentioned maybe once throughout the entire process. My dealer here in Wisconsin laid this all out for me without any pushback. I would highly recommend this dealership and salesperson to anyone looking for a Dodge, Ram, or Jeep. This is the second vehicle I have purchased from them. It is worth the drive to their dealership. If you ask for the POC, you will get it right away.

The Sales person I work with is Greg Auten

They are located in Beaver Dam, Wisconsin