Shut, I think I paid $600+ this year in New raska as you pay property tax on vehicles until they hit 10 years old. After that it's only like $40 a yearWell my registration here in Arizona is just over $500 for one year. Just over $900 if I pay for two years. My 05' TJR was $150 or so for 5 years.

5thGenRams Forums

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gas mileage

- Thread starter 1BADRAMLIMITED

- Start date

theblet

Legendary member

- Joined

- Feb 8, 2021

- Messages

- 6,167

- Reaction score

- 6,032

- Points

- 113

- Age

- 45

$500 a year for a ram 1500?! That’s insaneWell my registration here in Arizona is just over $500 for one year. Just over $900 if I pay for two years. My 05' TJR was $150 or so for 5 years.

Darksteel165

Legendary member

Well my registration here in Arizona is just over $500 for one year. Just over $900 if I pay for two years. My 05' TJR was $150 or so for 5 years.

Are we talking about registration or excise tax?

The Ram 1500 is a passenger car as far as my state is concerned and registration has nothing to do with what you drive unless it's got extra axles.

It's $60 every 2 years in Massachusetts, also know as Taxachusetts.

Davidbt

Well-Known Member

Arizona goes by value of the vehicle. As it depreciates, the registration will go down.

Idahoktm

Spends too much time on here

Are we talking about registration or excise tax?

The Ram 1500 is a passenger car as far as my state is concerned and registration has nothing to do with what you drive unless it's got extra axles.

It's $60 every 2 years in Massachusetts, also know as Taxachusetts.

Arizona calls it a vehicle license tax and they add that fee to the registration. When I bought my first new truck in AZ, I was shocked how expensive it was to register a vehicle. I was used to a flat fee system in Idaho. If I still lived in Arizona, it would have cost $1847 to register my TRX. I paid $66.15 in Idaho.

Darksteel165

Legendary member

Ah interesting.

We get taxed on everything in MA so it has 0 to do with your registration.

The registration is for your plates that you own (you don't get rid of plates) and that goes to the DMV (state)

My excise tax which sounds like what you guys have combined with your registration is a % of some random $ amount. This goes to the town you live in not the state.

You also pay this at the start of the year and within 60 days of buying a new vehicle.

You can get refunded prorated for the vehicle you sell regardless of if you buy a new one but I bet a lot of people don't know that as you need to fill out a paper forum and bring it to town hall.

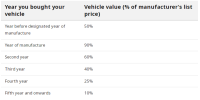

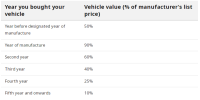

The first year my excise was $961. I lucked out because it goes by model year and the truck was a 2022 purchased in early 2023 so I dropped into second year of manufacture. If I got it in 2022 I would of been charged more. $1442 vs 691.

An 2022 Ram 1500 Limited is valued at $64,095 per MA

You take the adjusted value and it's $25 per every 1000 in value.

www.mass.gov

www.mass.gov

We get taxed on everything in MA so it has 0 to do with your registration.

The registration is for your plates that you own (you don't get rid of plates) and that goes to the DMV (state)

My excise tax which sounds like what you guys have combined with your registration is a % of some random $ amount. This goes to the town you live in not the state.

You also pay this at the start of the year and within 60 days of buying a new vehicle.

You can get refunded prorated for the vehicle you sell regardless of if you buy a new one but I bet a lot of people don't know that as you need to fill out a paper forum and bring it to town hall.

The first year my excise was $961. I lucked out because it goes by model year and the truck was a 2022 purchased in early 2023 so I dropped into second year of manufacture. If I got it in 2022 I would of been charged more. $1442 vs 691.

An 2022 Ram 1500 Limited is valued at $64,095 per MA

You take the adjusted value and it's $25 per every 1000 in value.

Motor Vehicle Excise

RVTRKN

Well-Known Member

- Joined

- May 20, 2020

- Messages

- 382

- Reaction score

- 260

- Points

- 63

- Age

- 66

There's a few States that are cheap for registration. Kentucky is cheap, until you have to pay a personal property tx on all vehicle's boats & RV's. Its the reason for me trading in a payed off 2019 3500 4X4 SRW HO CTD. My tax on that was $750.00, and when I sold the 5ver, it was a good reason to get rid of that tax bill. The kicker is, I am still liable for the 2023 tax bill, because I owned in on January 1. Every State gets their money one way or another. Idaho on the other hand is truly a registration friendly State, my brother bought my 04.5 4X4 CTD and registered it for $25.00 if I remember it correctly, in 2014.

RVTRKN

Well-Known Member

- Joined

- May 20, 2020

- Messages

- 382

- Reaction score

- 260

- Points

- 63

- Age

- 66

In Kentucky, your taxed on 1.25% of the value, that NADA says your vehicle is worth at the time of assessment, and there is no time limit. If NADA says its worth a $1000.00 your taxed on that number. We've considered moving to Tennessee, but then you have a 9.75% sales tax on everything, here in Kentucky its 6%Ah interesting.

We get taxed on everything in MA so it has 0 to do with your registration.

The registration is for your plates that you own (you don't get rid of plates) and that goes to the DMV (state)

My excise tax which sounds like what you guys have combined with your registration is a % of some random $ amount. This goes to the town you live in not the state.

You also pay this at the start of the year and within 60 days of buying a new vehicle.

You can get refunded prorated for the vehicle you sell regardless of if you buy a new one but I bet a lot of people don't know that as you need to fill out a paper forum and bring it to town hall.

The first year my excise was $961. I lucked out because it goes by model year and the truck was a 2022 purchased in early 2023 so I dropped into second year of manufacture. If I got it in 2022 I would of been charged more. $1442 vs 691.

An 2022 Ram 1500 Limited is valued at $64,095 per MA

You take the adjusted value and it's $25 per every 1000 in value.

View attachment 170532Motor Vehicle Excise

www.mass.gov

6of36

Spends too much time on here

Michigan is 6% sales tax, and plates are by vehicle value. I transferred my plate, so only cost $12 for transfer, until mine expires in May. When I renewed in may, on my 21 Durango, it was something like $225. It will be $300 or more next year. It goes by sale price of vehicle, then goes down a couple percent per year, for I think it's 10 years, then remains that price for life.

RVTRKN

Well-Known Member

- Joined

- May 20, 2020

- Messages

- 382

- Reaction score

- 260

- Points

- 63

- Age

- 66

I didn't mean to throw you under the buss, but towing at over 65 MPH not only is less safe but your MPG ( does that help) will drop considerably. I went over the top on the comparison with Semi's, sorry!!!Why you want to put it on me??? Why, why, why?? I was trying to go along with the fuel mileage. Pulling our 5,500lb travel trailer, @ 65 mph we average 11.1 mpg. Anything over and it eats fuel, and since we live in Arizona, anything much slower, in my experience, will get you run over. If I still had my 3500 Cummins and had the right tires on the trailer, I would probably be comfortable doing 70 or 75.

Darksteel165

Legendary member

Oh don't get it confused.In Kentucky, your taxed on 1.25% of the value, that NADA says your vehicle is worth at the time of assessment, and there is no time limit. If NADA says its worth a $1000.00 your taxed on that number. We've considered moving to Tennessee, but then you have a 9.75% sales tax on everything, here in Kentucky its 6%

In MA you pay full sales tax of 6.25% on the sale price of the vehicle offset if there is a trade in value.

You also get charged Excise tax every year, including right when you buy it.

Davidbt

Well-Known Member

It was meant to be funny.I didn't mean to throw you under the buss, but towing at over 65 MPH not only is less safe but your MPG ( does that help) will drop considerably. I went over the top on the comparison with Semi's, sorry!!!

spyder

Well-Known Member

- Joined

- Nov 15, 2021

- Messages

- 239

- Reaction score

- 296

- Points

- 63

- Age

- 43

If the weather is good on the week I'm trying to do it, I'll be doing a ~4500 mile trip that will be about 98% freeway at 75+ from California to Missouri and back, with some side trips. I'll keep track of all the data and report back.Truck is brand new, just did the first oil change at 3503 miles. After this one, I'll go off the oil monitor recommendation for changes, but the first one I like to do a little earlier...even though I know it's probably not needed with modern machining, assembly, and oil tech.

Trip completed. Wound up doing 4025 miles in 65 hours and 12 minutes, making the average speed at about 61mph. That includes all of the idle time, in town driving, shopping, etc, and a little bit of off road time. Also, a +100mph run on a closed place where it is perfectly legal to do so. Most of the trip was cruise control set at between 73 and 83 mph, elevation changes from 200 foot to 7000 foot and there was a couple hundred pounds of stuff in the truck besides me. Not a heavy load at all.

87 octane fuel was bought anytime it was available. A few times I had to buy 88, and once the only options were 85 and 91, so for that fillup I did half 91 and half 85. Don't know if that made a difference or not, but I didn't want to run 85 in my engine and it was a ten dollar savings over using all 91.

Hand calculated fuel mileage for the entire trip was 18.094mpg.

With the cruise control set at 103 mph, the dash reading was 13mpg over a full mile.

The dash display, when I got home, read 21.3mpg but it fluctuates wildly based on the last couple hours worth of driving. While running 80mph into a 50 mph headwind through Nebraska and Wyoming, the overall trip mpg display dropped down to 14.6 over the course of an hour, and then quickly went back up to ~18 when I got through the wind. The last 40 or so miles before getting home the dash display raised quickly to 21.3, because it was all a mild downhill. The instant page mpg average display and the trip display matched the whole time.

I'm VERY happy with the economy of the new truck. Had I done this trip in the Rebel it would have averaged significantly lower mpg and significantly higher cost. I do a lot of driving and fuel savings was a large part of my decision to "Downgrade". The Bighorn does everything I need it to do and saves me quite a bit of money throughout the course of a year. The only problem I had was the factory battery being junk. The negative post showed some blue fuzzy corrosion which I cleaned up, and it immediately came back, with noticeable bubbling. It also drops down to 12.0v when parked. Time to get in to a dealer and have them warranty it out before it causes other corrosion issues.

RVTRKN

Well-Known Member

- Joined

- May 20, 2020

- Messages

- 382

- Reaction score

- 260

- Points

- 63

- Age

- 66

I'd just bite the bullet like I did, and replace the battery with a quality Gel Cell battery. They'll just throw in another cheap battery. I was lucky on my 4900 mile trip, that my cheap OE battery failed after my trip. I don't know the country of origin, but Walmart sells a AGM battery cheap, however my preference is the Duracell AGM, but their not cheap, and made in the USA.

A good thread on batteries.

A good thread on batteries.

spyder

Well-Known Member

- Joined

- Nov 15, 2021

- Messages

- 239

- Reaction score

- 296

- Points

- 63

- Age

- 43

I'd just bite the bullet like I did, and replace the battery with a quality Gel Cell battery. They'll just throw in another cheap battery. I was lucky on my 4900 mile trip, that my cheap OE battery failed after my trip. I don't know the country of origin, but Walmart sells a AGM battery cheap, however my preference is the Duracell AGM, but their not cheap, and made in the USA.

A good thread on batteries.

That's what I'll do, but I may as well get the "Free" cheapo battery. I can use it in the old Bronco. And I'd like the potential corrosion issues documented in case it turns out to be something worse later on down the road. Thanks for the link, I'll read up. I plan on using an Interstate H8, but I'm open to changing my mind after I read it. I've been using Interstates in everything for along time with no issues yet.

RVTRKN

Well-Known Member

- Joined

- May 20, 2020

- Messages

- 382

- Reaction score

- 260

- Points

- 63

- Age

- 66

As you'll read in the linked Thread, I went to Duracell for my RV and Boat, then bought the auto version for my wife's Highlander. I'm so impressed I bought one for the Ram.

BTW, that is smart to get the freebie, however I have an extra RV/Boat Duracell AGM as it is, no need for another.

BTW, that is smart to get the freebie, however I have an extra RV/Boat Duracell AGM as it is, no need for another.

foolishpride

Active Member

Trip completed. Wound up doing 4025 miles in 65 hours and 12 minutes, making the average speed at about 61mph. That includes all of the idle time, in town driving, shopping, etc, and a little bit of off road time. Also, a +100mph run on a closed place where it is perfectly legal to do so. Most of the trip was cruise control set at between 73 and 83 mph, elevation changes from 200 foot to 7000 foot and there was a couple hundred pounds of stuff in the truck besides me. Not a heavy load at all.

87 octane fuel was bought anytime it was available. A few times I had to buy 88, and once the only options were 85 and 91, so for that fillup I did half 91 and half 85. Don't know if that made a difference or not, but I didn't want to run 85 in my engine and it was a ten dollar savings over using all 91.

Hand calculated fuel mileage for the entire trip was 18.094mpg.

With the cruise control set at 103 mph, the dash reading was 13mpg over a full mile.

The dash display, when I got home, read 21.3mpg but it fluctuates wildly based on the last couple hours worth of driving. While running 80mph into a 50 mph headwind through Nebraska and Wyoming, the overall trip mpg display dropped down to 14.6 over the course of an hour, and then quickly went back up to ~18 when I got through the wind. The last 40 or so miles before getting home the dash display raised quickly to 21.3, because it was all a mild downhill. The instant page mpg average display and the trip display matched the whole time.

I'm VERY happy with the economy of the new truck. Had I done this trip in the Rebel it would have averaged significantly lower mpg and significantly higher cost. I do a lot of driving and fuel savings was a large part of my decision to "Downgrade". The Bighorn does everything I need it to do and saves me quite a bit of money throughout the course of a year. The only problem I had was the factory battery being junk. The negative post showed some blue fuzzy corrosion which I cleaned up, and it immediately came back, with noticeable bubbling. It also drops down to 12.0v when parked. Time to get in to a dealer and have them warranty it out before it causes other corrosion issues.

Looking at your numbers, I would assume you have the 3.21 rear axle? I have the 3.21 also, and am getting similar numbers. Son-In-Law has the 3.92, and his mileage is much lower.

spyder

Well-Known Member

- Joined

- Nov 15, 2021

- Messages

- 239

- Reaction score

- 296

- Points

- 63

- Age

- 43

Yes, 3.21 rear. If I had driven the Rebel I traded in on this one, it would have been significantly worse. Rebel looks cooler, but saving hundreds of dollars per month is better. At least for where I am in my financial world. The guys that don't care about fuel costs "because I bought a truck" must make a helluva lot more than me.

RVTRKN

Well-Known Member

- Joined

- May 20, 2020

- Messages

- 382

- Reaction score

- 260

- Points

- 63

- Age

- 66

Or they have a trailer that is at the top of the CGWR range of the 1500, so the 3:92 would be appropriate. They save money, if you compare the cost of the 2500 with a 6.4 Hemi to the 1500 5.7 Hemi. My need is at the lower end of the 1500 GCWR, so 3:21 work well for me.Yes, 3.21 rear. If I had driven the Rebel I traded in on this one, it would have been significantly worse. Rebel looks cooler, but saving hundreds of dollars per month is better. At least for where I am in my financial world. The guys that don't care about fuel costs "because I bought a truck" must make a helluva lot more than me.

Davidbt

Well-Known Member

We have a 26' travel trailer that weighs 5,500lbs. My 3.92 gears pulls it no problems. I've had a 2500 CTD and a 3500 CTD. I like my 1500 because we have the smaller trailer it's not hard to reach things in the back of the truck.Or they have a trailer that is at the top of the CGWR range of the 1500, so the 3:92 would be appropriate. They save money, if you compare the cost of the 2500 with a 6.4 Hemi to the 1500 5.7 Hemi. My need is at the lower end of the 1500 GCWR, so 3:21 work well for me.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)

Members online

Total: 2,008 (members: 5, guests: 2,003)