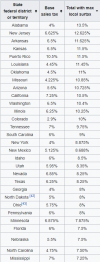

Invoice is the New MSRP

Paying invoice is now paying full price.

I sent this simple email to over twenty dealerships.

"I am looking to order a 2021 Ram 1500 Limited. I am sending this to multiple dealers and will go with the lowest price below invoice not including rebates or incentives. Please send me your lowest price. Build attached."

Not one quoted me a price above invoice. Many quoted me invoice or 1% below. My lowest initial quote was 6% below.

If you pay invoice minus all available rebates and incentives, you are paying full price.

As most of you know invoice minus holdback is no longer what the dealer really pays for vehicles.

The below is from James Bragg.

Today

about 90% of “dealer cash” dollars are allocated to secret, “below-the-line” programs that are typically tied to multi-month total sales targets and other non-sales objectives that are set dealer-by-dealer. And no one can tell you who’s got what targets, where they stand against them, or even when those programs start and end.

I get the straight skinny on these programs right from the horse’s mouth.

• A woman who got her popular import-brand midsize sedan for $800 below invoice was thanked by the sales manager, who told her that her purchase and the others that day got the dealership to the automakers’ multi-month sales target, earning them another $1,000 for each vehicle sold. (That brand’s average dealer sold 1,197 new vehicles last year, 100 per month.)

• When a couple paid $2,000 below invoice for Detroit’s best-selling pickup in December, a friend at the dealership told them, “Your purchase got us to the sales level for that truck that earns us an extra $750 for every unit we’ve sold this year.”

• A customer paid $2,317 below invoice for one of the most popular Japanese midsize sedans. The sales manager said he lost over $1,500 on the sale. Then he added, “I did that because the automaker has us on a ‘stair-step’ incentive program. As we reach each higher total sales target, we get more money per car for all the cars we’ve sold. Your sale got us to the next plateau.”

• A Detroit automaker ran an “Employee Price” consumer promotion. That was about 5% below the total dealer invoice. But at the end of two quarters some customers bought their vehicles for as much as $2,000 below that price. A salesperson told one of them

: “The factory is running quarterly promotions in which we can earn six-figure bonuses by reaching our sales targets. So we didn’t care how much we lost on your deal.”

• It can be tough to deal on an all-new design because the early demand usually exceeds the early supply. But a customer’s wife wanted a “hot” redesigned import sedan in its first week on the market, and as he told me, “It’s a lot cheaper to trade in cars than to trade in wives.” Nine of the ten price proposals he received were at the full MSRP. But one dealer sold the car for $2,500 less, $500 to $600 below the invoice price. In week #1! The owner took him aside quietly and said, “Here’s why I did that. My sales target is 1,000 new cars. I’m so close to that bonus check I can almost taste it.” I guessed that was about $500 per vehicle — a half million bucks. I learned later from a reliable source that the real number for that brand was $1,200 to $1,800 per vehicle. (You can do the math.)

Rebate vs. lower interest: Which car incentive is right for you? LINK

The Best Time to Buy Your Ram LINK

How to Get the Best Price on Your New Ram

UPDATE: I am rarely updating this anymore so some of the information may be out of date. Check the most recent comments for new information. 2/11/22 With differing degrees of work you can get a good to great price on your new truck. We will start with the discounted price on the truck and cover...

5thgenrams.com

The myth about dealer cash incentives

Author’s Note: The catalyst for this series was the eye-opening discovery that over the last 20 years, the dealer invoice price has been turned into a bloated imposter that has nothing to do with any true vehicle cost — a fact which torpedoes the foundation for the ubiquitous “target price”...

clark.com