I can help with #1.

I think it's quarterly the Manufacturers give the "hold back" amount to the dealerships. The "hold back" amount is calculated differently depending on the manufacturer.

Just as an example, it might be something like:

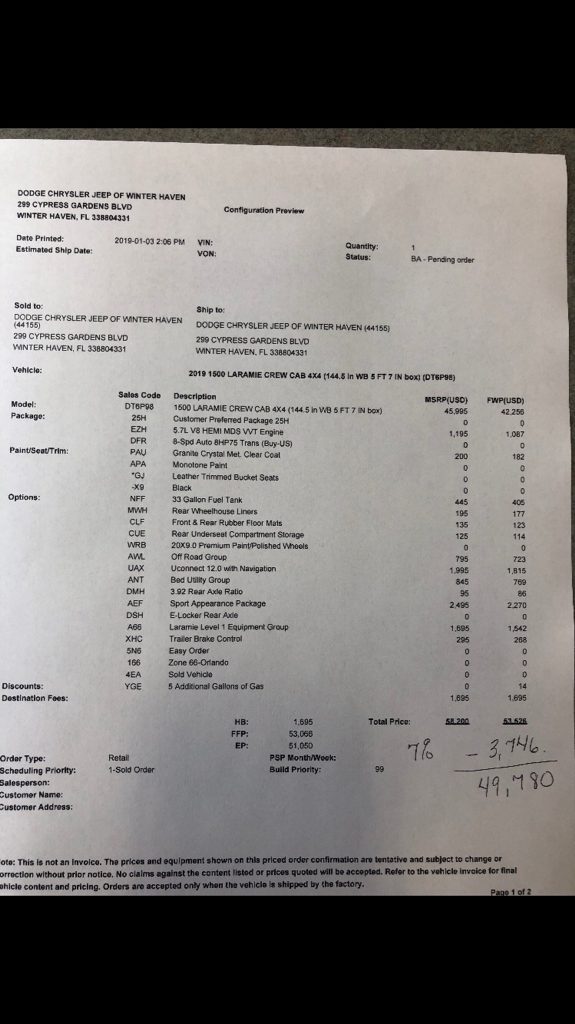

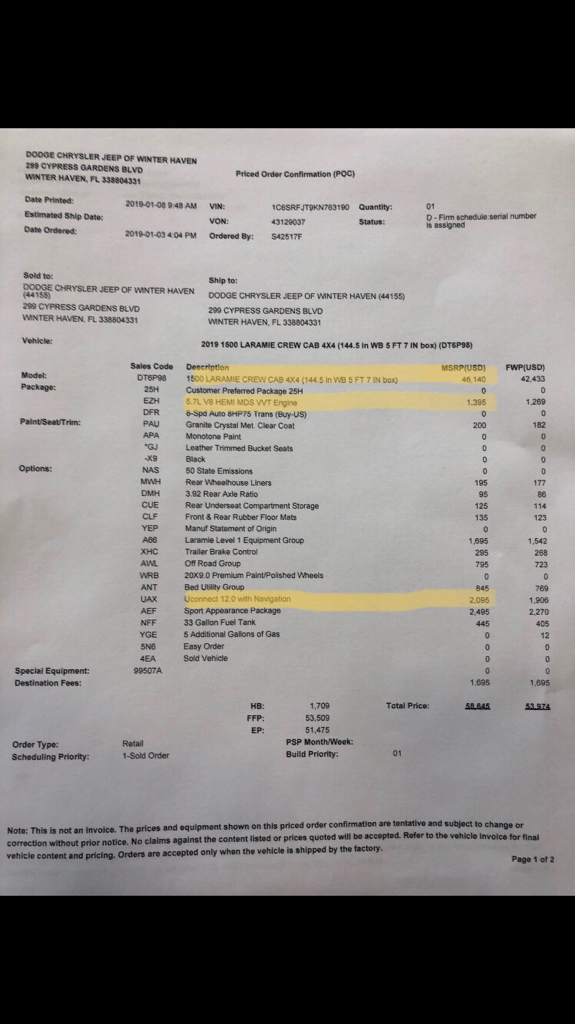

MSRP (Sticker) - $50,000 (including destination charges)

Destination Charges - $1,695

Invoice - $45,000

Markup from Invoice ($50,000 MSRP - $1,695 Destination Changes = $48,305 - $45,000 Invoice = $3,305 markup)

Holdback - $45,000 Invoice * 3% = $1,350

At the end of the quarter, the dealer that the vehicle was originally delivered to will get $1,350 from the manufacturer for selling the vehicle. If the vehicle was acquired by dealer trade, the acquiring dealer does not get the hold back as it would still go to the dealer where the vehicle was originally delivered to.

When I used to sell cars 20+ years ago, the dealership would dip into the holdback and give it as a discount to sell the old model year vehicles. Of course, they couldn't dip into the holdback it we got it from a different dealership on a trade.

Some manufacturers include the destination charges when calculating the hold back amount, and some use different percentages (2%, 2.5%, etc). GM, from what I remember, uses 3% and I don't know if that includes Destination charges or not.