Mr. Hindsight

Well-Known Member

- Joined

- Dec 11, 2019

- Messages

- 206

- Reaction score

- 85

- Points

- 28

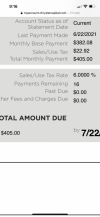

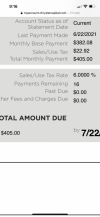

Thanks for the replies. I’m guessing it’s the taxes also (which I wasn’t aware of when I posted originally) but I can’t seem to get the numbers she quoted me. My base payment is $382.08 and my taxes are $22.92 for a total of $405.00 monthly.

$29,036.00 residual + $6,480.00 remaining 16 payments= $35,516.00 x .06 % taxes= $2,130.96 + $35,516.00= $37,646.96

$172.12 over what she quoted and still not factoring in a $350.00 purchase option fee.

$29,036.00 residual + $6,480.00 remaining 16 payments= $35,516.00 x .06 % taxes= $2,130.96 + $35,516.00= $37,646.96

$172.12 over what she quoted and still not factoring in a $350.00 purchase option fee.