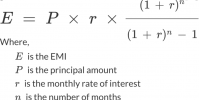

This is a long read and assumes you're paying the monthly payments for each loan to completion, but if you want to understand why you're wrong, have a look. Most people don't get this. The interest rate itself isn't front loaded, but the interest-portion of each equal payment is highest at the beginning of the payment schedule due to the formula for EMI (Equal Monthly Installment) amortized loans...this is a due to the actual formula used to calculate your monthly payments on standard car loans and mortgages:

View attachment 86293

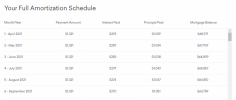

Plugging in the relevant values for a 70K car loan at 5.0% interest for 60 months gives you a monthly payment of ~ $1321 with a payment schedule of (using a standard online calculator based on the above formula ...they all are...this one is from

https://www.creditkarma.com/calculators/amortization)

View attachment 86294

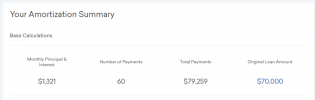

Notice that the interest portion of each of your payments is largest at the beginning, aka front-loaded. As you pay each subsequent payment the interest portion decreases and the principal portion increases. This is how the formula works. So you're paying the greatest amount of interest per payment on the initial payments. Your remaining payoff balance is only decreasing by the principal portion of each payment. Over the course of the loan, you'll pay $1321 * 60 = $79,259, or $9,259 in total interest above the purchase price of the vehicle, or from the website:

View attachment 86300

So say a dealer is requiring you to pay 6 months of payments before refinancing, and that's what you do. And say that you only get a slightly better interest rate from another bank at 4.9% instead of 5. Using your logic, 4.9 is less than 5, and in your words, the sooner you refinance to a lower rate the sooner you pay less interest.

This is where you and most people overlook the effect of resetting the amortization schedule when refinancing. You're focusing on the tree and forgetting about the forest. You would have been better off just finishing off paying the 5.0% loan and not refinancing. Why? Because, you've already paid 6 full payments, which is $1321 * 6 = $7,926...but your principal only decreased by $70,000 - $63759 = $6,241 due to the front-loaded interest portion that is normal with amortized/EMI loans. So now you go refinance with ANOTHER 5 year loan with a brand new payment schedule, starting at $63,759 as your starting principal (from the table above after 6 months of payments from your old loan). Plug a 5 year loan on $63,759 at 4.9% APR into that same online calculator and you'll get:

View attachment 86301

So now of course your payments are lower....but you've effectively now done a 66 month loan instead of a 60 month loan. So now over the course of this new loan, you'll end up paying a total of about $1200 * 60 = $72,018....and then you add on the $7,926 that you paid before you refinanced and you're at $72,018 + $7,926 = $79,944...which is greater than your original total of $79,259 by $685 bucks. You would have been better off just keeping your 5% loan and not refinancing; you would have saved $685 bucks. You would have needed at least a 4.5% interest rate instead of 5.0% to offset the front-loaded interest and overall loan-lengthening (amortization schedule reset) of a whole new loan.

And that's what I told the gentleman earlier, that he'd need a significantly lower interest rate to justify the refinance (assuming you're paying the EMI payments to completion).

So if you plan to pay the exact EMI through the course of the each loan, refinancing isn't always the right choice. Only way the refinance makes sense in this particular case is if A) you

need the lower monthly payment and you don't care that you'll be paying extra overall in the end, or B) you intentionally overpay the refinanced loan with your older/higher monthly payment.

This effect isn't that big on car loans, but on mortgages it can be a drastic increase. This is why the same mortgage company will often come after you with an offer to refinance at a slightly lower rate after you're already part-way through your mortgage at a slightly higher rate. It seems like a great deal at first, but they're testing you to see if they can take advantage before you realize you're getting duped. Because they're betting you'll be like most and just pay the new/lower EMI through the entire new term of the new loan and make them significantly more money off of you in the long run. For example, refinancing a $450K house at 4.9% APR on a 15-year loan after previously paying 6 months on a 5.0% version of the same loan...will net the bank about 17K more of your money by the time you're done.