5thGenRams Forums

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Funny Memes and Funny Pictures 2.0 - NO POLITICS or NSFW, Find the other thread

- Thread starter T-Boned-Tony

- Start date

yankeefan31569

Ram Guru

- Joined

- Apr 21, 2020

- Messages

- 534

- Reaction score

- 412

- Points

- 63

- Age

- 46

yankeefan31569

Ram Guru

- Joined

- Apr 21, 2020

- Messages

- 534

- Reaction score

- 412

- Points

- 63

- Age

- 46

Threesuns1

Ram Guru

Threesuns1

Ram Guru

Threesuns1

Ram Guru

MrWeatherman

Active Member

- Joined

- Oct 14, 2022

- Messages

- 50

- Reaction score

- 97

- Points

- 18

- Age

- 38

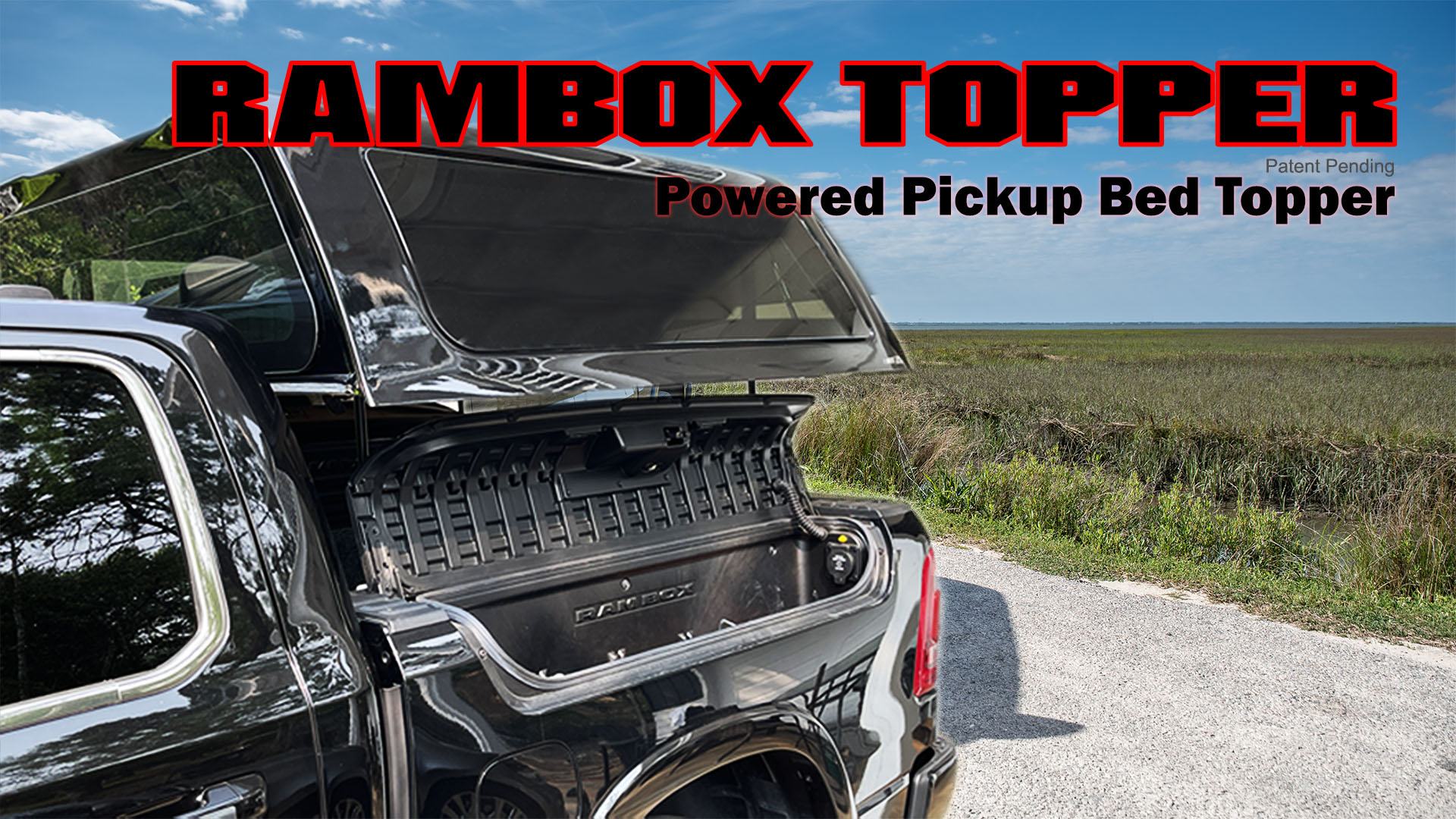

Not sure if this was posted before

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Threesuns1

Ram Guru

Threesuns1

Ram Guru

Mountain Whiskey

Spends too much time on here

Mountain Whiskey

Spends too much time on here

theblet

Legendary member

- Joined

- Feb 8, 2021

- Messages

- 6,163

- Reaction score

- 6,027

- Points

- 113

- Age

- 45

I feel bad for people’s retirement accounts since 2020. I know my investments are junk now. Don’t see it getting any better til 2024 or later

I feel bad for people’s retirement accounts since 2020. I know my investments are junk now. Don’t see it getting any better til 2024 or later

I was this close >< to retiring from full time and going PT contract only this year and while realistically I still could, I'm down (not out) about 15% of my portfolio and would like to rebuild some of that before I pull the trigger. In retrospect, I was a bit to heavy in the stonks and should have pulled everything back at the end of 2021 when I had the opportunity (custodial move on employer 401k) and (had I known) peaked my largest account (the 401k). 12-18 months is still in my sights and I think doable on the recovery. Been buying the dip so hope to see that return within that timeframe. Hard to make an exit plan with the way the market is right now though It's so bad I'm betting against the indexes in some market linked notes (and making a little money from them). I did also just dump some cash into some decent stable dividend stocks I wasn't already in.

theblet

Legendary member

- Joined

- Feb 8, 2021

- Messages

- 6,163

- Reaction score

- 6,027

- Points

- 113

- Age

- 45

That sux man! At least you have a good plan to be able to make it.I was this close >< to retiring from full time and going PT contract only this year and while realistically I still could, I'm down (not out) about 15% of my portfolio and would like to rebuild some of that before I pull the trigger. In retrospect, I was a bit to heavy in the stonks and should have pulled everything back at the end of 2021 when I had the opportunity (custodial move on employer 401k) and (had I known) peaked my largest account (the 401k). 12-18 months is still in my sights and I think doable on the recovery. Been buying the dip so hope to see that return within that timeframe. Hard to make an exit plan with the way the market is right now though It's so bad I'm betting against the indexes in some market linked notes (and making a little money from them). I did also just dump some cash into some decent stable dividend stocks I wasn't already in.

That stinks. I'm sorry to hear that. I'm in an investment group and one of the members is a former programmer from Microsoft. He created an algorithm to automate trading based on intradaily movements. While his robotic trading works for stocks, he has his money in crypto simply because it's more volatile so sees more movement, resulting in more frequent trading activity. I put a small amount of money in coinbase to try it out and have been pleased with the results. I am concerned with the tax implications of frequent trading though, so I'm going to set up a self-directed Roth IRA and let the robotic trading run until I turn 65 in 12 more years.I was this close >< to retiring from full time and going PT contract only this year and while realistically I still could, I'm down (not out) about 15% of my portfolio and would like to rebuild some of that before I pull the trigger. In retrospect, I was a bit to heavy in the stonks and should have pulled everything back at the end of 2021 when I had the opportunity (custodial move on employer 401k) and (had I known) peaked my largest account (the 401k). 12-18 months is still in my sights and I think doable on the recovery. Been buying the dip so hope to see that return within that timeframe. Hard to make an exit plan with the way the market is right now though It's so bad I'm betting against the indexes in some market linked notes (and making a little money from them). I did also just dump some cash into some decent stable dividend stocks I wasn't already in.

Fatherof3

Spends too much time on here

HemiDude

Spends too much time on here

LOL this was a good one to start my day with!