Willwork4truck

Spends too much time on here

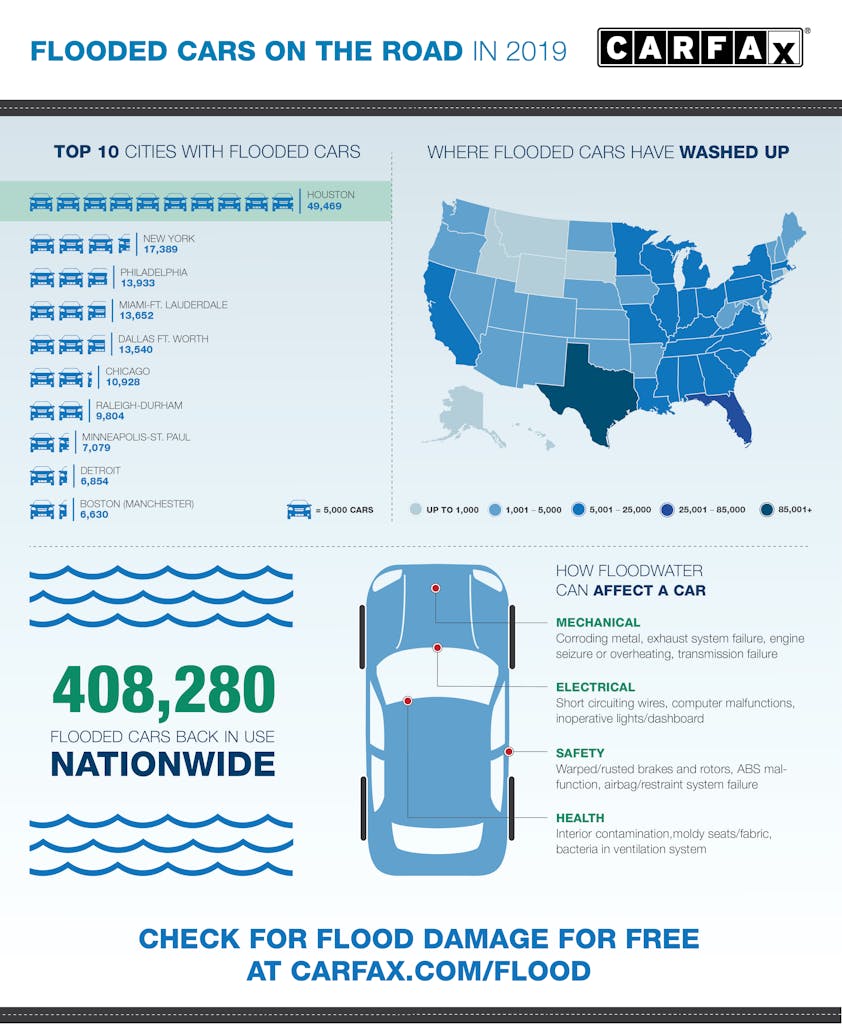

Galveston, Houston, Beaumont and other such areas must have a lot of new water damaged trucks now... what does the dealer do with them?

That was good for used cars but I'm still a bit unclear about the dealers stock. Aren't those cars actually on a floor plan where the dealer is just paying the factory a certain "fee" and it's actually the car maker who retains title to them as new? If so, then it's the carmaker who has to absorb the loss of all the "spoiled goods". I suppose there are the same auction services that the factory can use.This is actually a pretty good article on what happens to all of those cars.

What happens to flood damaged cars.

So is the dealer on the hook for flood damage (thru their insurance)?Dealers have “dealer open lot insurance policies” they’re supposed to report the value of their inventory on a monthly basis to the insurance company. This also covers vehicles that are in for service.