DevinB

Active Member

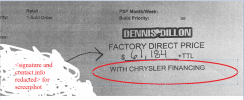

Just wondering how your experience went? Mine had/has been going well save for a potential bait-and-switch gotcha with a financing incentive. Signed POC sheet that I signed says a price is valid "With Chrysler Financing"...says it verbatim right on the stamp. Fast forward about 2.5 months and the truck is almost at dealer, and when I was chatting with the salesperson about intended financing via Chrysler, he relayed that the 0% Chrysler APR financing doesn't count for the 2k discount...says it has to be 'conventional' financing....seems like a classic bait and switch. Trying to decide whether to pull the plug and go after my deposit (can get it back pretty easily). Any good or bad experiences with them or similar financing gotchas?